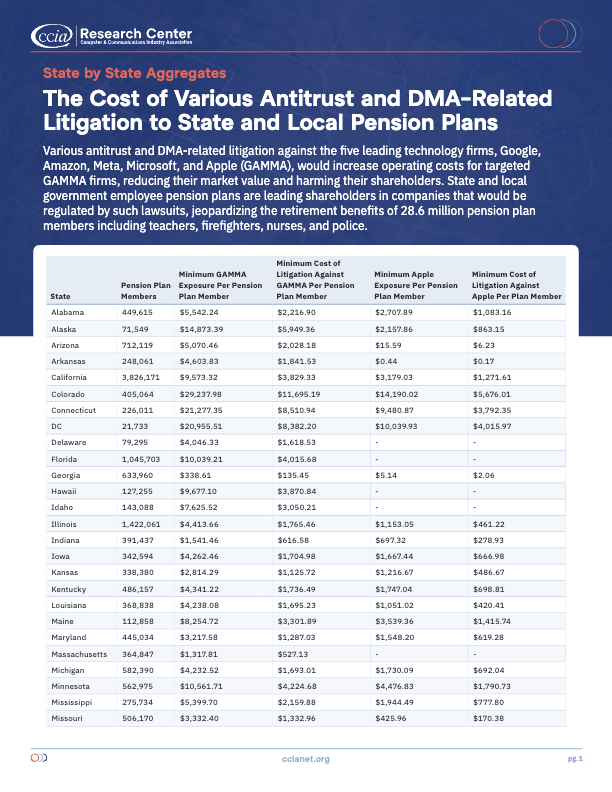

Antitrust and DMA-related litigation would increase operating costs for GAMMA firms, including the most recent target, Apple, reducing their market value and harming their shareholders. State and local government employee pension plans are leading shareholders in companies that would be impacted by such lawsuits, jeopardizing the retirement benefits of 28.6 million pension plan members including teachers, firefighters, nurses, and police.

Notes and Sources:

- Estimates from CCIA Research Center calculations using publicly available data, including from https://publicplansdata.org/.

- All estimates are minimum, lower-bound estimates, assuming a 10% of global turnover financial impact to targeted firms. Estimates are based on pension plan Top 10 Direct Holdings Only. Estimates ignore direct holdings outside of the top 10, and ignore indirect holdings through, e.g., index funds, and as such undercount pension plan exposure.

- “GAMMA” refers to the leading 5 publicly traded technology companies, Google, Amazon, Meta, Microsoft, and Apple.

- “Pension Plans” and “Public Sector Pension Plans” refer to state and local government employee pension plans.

About This Map

This map shows the estimated aggregate financial impacts to state and local government employee public pension plans and plan members that would result from antitrust and DMA-related litigation against the five GAMMA firms collectively and Apple specifically. State and local government employee pension plans are leading shareholders of the the GAMMA firms, including Apple.

The first group, “total cost to public sector pensions of litigation against GAMMA,” shows the financial impacts expected upon successful lawsuits due to the direct impact to five U.S. businesses that are targeted: Google, Amazon, Meta, Microsoft, and Apple. The second group, “cost to pensions invested in Apple stock,” shows the direct financial impact to Apple as a result of the antitrust and DMA-related litigation.

The underlying analysis uses data from publicly available data on public pension plans, stock market data, public company financial disclosures, and Public Plans Data. The analysis assumes that successful litigation would cost targeted firms 10% of revenues per year in perpetuity, consistent with DMA penalties of 10% of global turnover. The analysis looks at top 10 holdings of pension plans, and only looks at direct holdings, excluding indirect holdings from index funds and similar sources. In other words, GAMMA holdings that fall outside a pension plan’s top 10 holdings are counted as zeroes, and indirect holdings through index funds are counted as zeroes. As a result, the impacts estimated in this analysis are lower bounds, and actual impacts to pension plans from litigation resulting in costs of 10% of global turnover would likely be much higher.

Why This Matters

State and local government employee pension plans are major institutional investors, relied upon by at least 28.6 million Americans for retirement income, that typically invest heavily in securities issued by U.S. firms that would be significantly adversely impacted by antitrust and DMA-related litigation. These lawsuits would significantly increase operating costs for regulated businesses, decreasing the market value of stocks and other securities from major companies like Google, Facebook, Apple, Microsoft, and Amazon.

State and local government employee pension plans, as leading investors in GAMMA, would suffer at least $86.1 billion in losses in public sector pensions upon successful litigation, eliminating at least 1.6% of the value of pension plan holdings. The Apple-specific cost to pensions is at least $27.5 billion, which would eliminate at least 0.5% of the value of pension plan holdings.

On a per-plan-member basis, successful antitrust and DMA-related litigation against GAMMA collectively would cost the average state and local government employee pension plan member at least $3,015, and successful litigation against Apple alone would cost the average pension plan member $964.