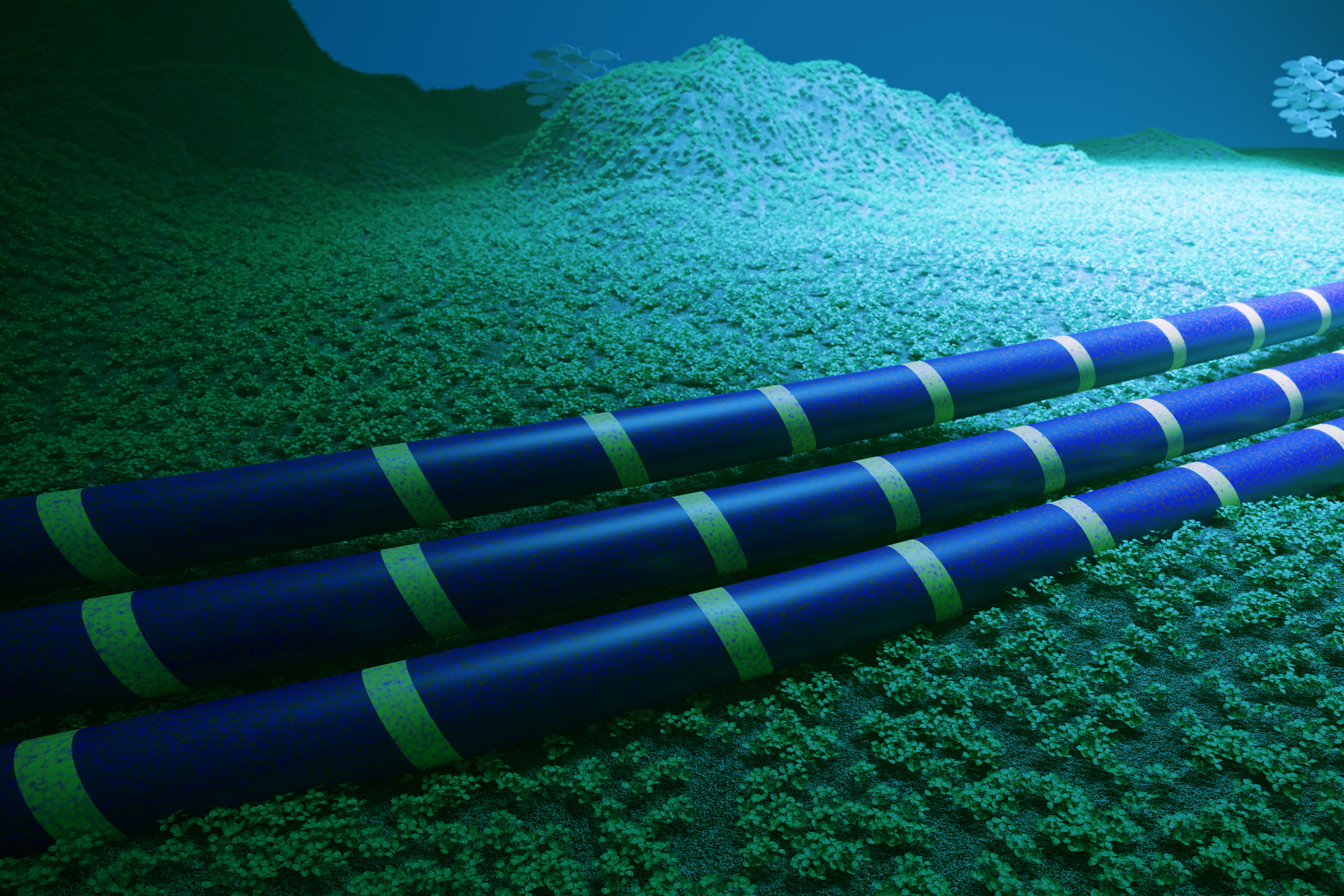

Underwater fiber optic cables on sea floor. (3d render)

Underwater fiber optic cables on sea floor. (3d render) As policymakers grapple with the arrival of a new general purpose technology – artificial intelligence – they would be wise to consult the policy playbook from a transformative technology that came before: the internet. The proposed temporary pause on state-level AI regulation in recent legislative proposals isn’t just sound policy—it emulates a proven strategy that helped unlock the internet’s economic potential, supported U.S. digital leadership, increased U.S. GDP and federal tax receipts, and could do the same for AI. Recall the Internet Tax Freedom Act.

A Lesson from Internet History

Twenty-seven years ago, Congress faced a similar challenge with the nascent internet. State and local governments were contemplating distortionary and inconsistent taxes on internet access, threatening to significantly slow internet adoption and the development of the digital economy before it had significantly emerged. The solution was the Internet Tax Freedom Act of 1998, which established a pause on state and local taxes on internet access and multiple or discriminatory taxes on electronic commerce.

The parallels between today’s AI regulatory landscape and the internet’s early days are striking. Just as the internet represented a general purpose technology with transformative potential, AI stands poised to revolutionize how we work, communicate, and solve complex problems. And just as the internet faced the threat of inconsistent and potentially onerous state-level taxation that could have stunted its growth, AI now confronts an inconsistent maze of proposed state regulations that threaten to create compliance nightmares and innovation barriers.

The Internet Tax Freedom Act created breathing room for a revolutionary technology to mature, without taxes discouraging the adoption of internet service. This increased the speed of adoption of internet service and digital services, and helped the U.S. become the leading digital technology powerhouse. This same logic applies to AI regulation today.

The Economic Evidence is Clear

The economic impact of the Internet Tax Freedom Act has been substantial and well-documented. By preventing inconsistent and onerous state taxes that would have increased costs and created barriers to adoption, the tax pause helped accelerate internet penetration across American households and businesses. This acceleration had cascading effects throughout the economy.

One way to quantitatively estimate the economic benefits of the Internet Tax Freedom Act is to consider the counterfactual: what would have happened if states were imposing taxes on internet service?

- A 2014 study from the Phoenix Center estimated that state taxes on broadband internet service causing a 2.5% price increase would lead to about 5 million lost broadband internet connections, split between fixed and mobile. Note that this is a conservative estimate, as many states would have imposed taxes in excess of 2.5%.

- Using FCC 2014 Estimates for fixed and mobile internet connections, we can estimate that this would have amounted to a 1.2% reduction in fixed broadband internet connections and a 1.7% reduction in mobile broadband internet connections.

- Using estimates of the relationship between internet connectivity and GDP from Czernich et al. from 2011, Edquist et al. from 2018, and the ITU from 2012, we can translate these lost broadband connections into GDP impacts of about $48 billion in 2014, which is worth about $65 billion today.

- Based on FRED data showing that GDP growth translates into federal tax receipts at a rate of about 17% in recent decades, this implies that the Internet Tax Freedom Act generated over $8 billion in incremental federal tax receipts in 2014, which is worth about $11 billion in today’s dollars.

It’s not difficult to see where this growth came from. The broadband revolution that followed the Internet Tax Freedom Act was transformative. Federal Communications Commission data shows that high-speed internet adoption grew from practically zero in 1998 to covering over 90 percent of American households today. This growth facilitated entire new sectors—from e-commerce to cloud computing platforms to the gig economy—while making existing industries more productive, efficient, and competitive.

Perhaps most importantly for federal policymakers, this economic growth translated directly into increased federal tax revenues. The Bureau of Economic Analysis estimates that the internet economy now generates $2.6 trillion in economic activity annually, creating a substantial tax base that didn’t exist before the Internet Tax Freedom Act. The federal government’s revenue gains from this expanded economic activity have far exceeded any theoretical losses from preventing state-level internet taxes.

AI’s Economic Potential

The parallel opportunity with AI is enormous. Recent research commissioned by CCIA surveying consumers and enterprise users found that nearly 40 percent of workers already use AI applications at work several times daily, with this number expected to grow dramatically. This adoption is driving measurable productivity gains across sectors from healthcare to manufacturing to professional services.

AI adoption is starting to accelerate, with the potential for enormous economic benefits. This creates both tremendous opportunity and significant risk. The opportunity lies in AI’s potential to drive productivity growth, solve complex societal challenges, and create new industries. McKinsey estimates that generative AI could contribute up to $4.4 trillion annually to the global economy.

The risk is that inconsistent state regulations could fragment the AI ecosystem, creating compliance costs and reduced economies of scale that burden innovation and slow adoption. When companies must navigate inconsistent and conflicting state regulatory frameworks for a technology that operates seamlessly across borders, the result is increased costs, reduced innovation, and slower economic benefits.

Why State-Level Fragmentation Hurts

The economic literature on regulatory federalism is clear: for technologies with strong economies of scale and cross-border applications, fragmented state regulation creates inefficiencies that harm overall economic welfare. This is particularly true for general-purpose technologies like AI that benefit from standardization and interoperability.

Consider what happens when an AI company must comply with different requirements in California, Texas, New York, and Florida. Resources that could go toward improving the technology instead go toward legal compliance. Features that could benefit users nationwide get delayed or cancelled because they don’t work under every state’s rules. Innovation slows and the economic benefits take longer to materialize. Fewer potential customers utilize AI tools due to the diminished benefits and increased costs, and AI adoption slows down.

The United States is not the only major economy to have learned important lessons about the costs of regulatory disharmony at the political subdivision level. In the European Union, the recent Draghi Report has identified numerous harms to EU competitiveness arising from the lack of harmonized rules and policies between member states. Policy analysts and commentators have noted the particular application of the Draghi Report’s critiques to Europe’s lackluster performance in the digital economy.

The Federal Revenue Opportunity

From a federal fiscal perspective, the case for an AI regulatory pause is compelling. Just as the Internet Tax Freedom Act generated far more federal revenue through economic growth than states lost in forgone taxes, a pause on AI regulation could create substantial federal revenue opportunities. We have previously estimated that generative AI could drive up to $269 billion in U.S. federal fiscal benefits over the next decade, averaging up to almost $27 billion per year, so long as regulations are consistent across jurisdictions and not discriminating against generative AI technology.

AI-driven productivity growth translates directly into higher wages, corporate profits, and economic output—all of which generate federal income and payroll taxes. Companies that can focus on innovation rather than regulatory compliance create more jobs, generate more revenue, and contribute more to federal coffers.

The Congressional Budget Office has noted that technology-driven productivity growth is one of the most reliable sources of long-term federal revenue growth. By ensuring that AI can develop and deploy efficiently, a regulatory pause could generate many billions in additional federal tax revenue over the coming decade.

The Path Forward

The lesson from the Internet Tax Freedom Act is clear: when faced with a general-purpose technology that could transform the economy, pausing state-level taxation and regulation to make way for a uniform federal approach can unlock enormous economic value. The internet’s growth under the tax pause created entire new industries, drove productivity gains across the economy, generated substantial federal tax revenue, and facilitated U.S. strategic leadership across the globe in digital technology.

AI represents an even greater opportunity. By learning from the internet’s successful policy framework, policymakers can help ensure that AI’s benefits are realized quickly and broadly, generating the economic growth and federal revenue that will define America’s competitive position in the global economy.

The choice is straightforward: embrace the proven approach that worked for the internet, or risk fragmenting another transformative technology before it can reach its full potential. The Internet Tax Freedom Act shows us the way forward—now we need the wisdom to follow that path again.