Credit: msderrick

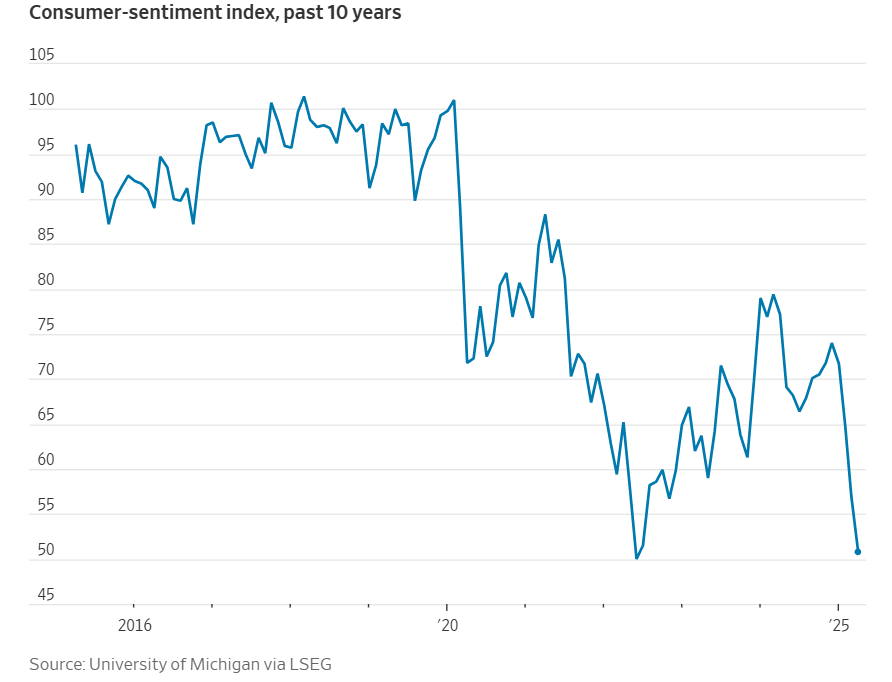

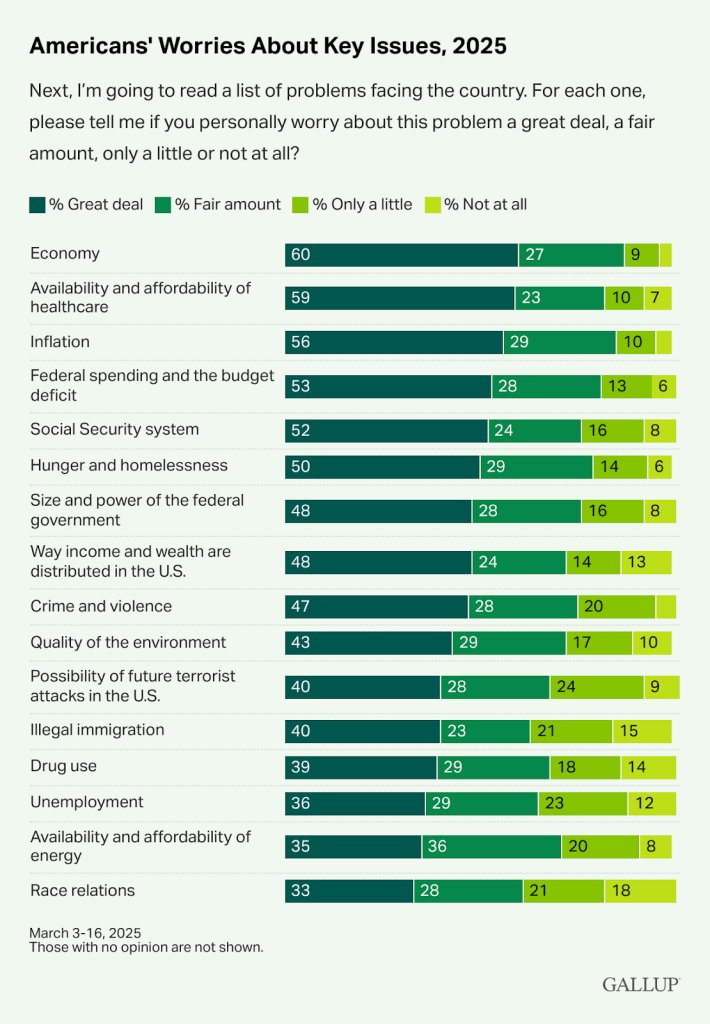

Credit: msderrick The Biden Administration pursued federal antitrust investigations into six of the “Magnificent Seven” leading technology firms, including Google, Meta, Amazon, Apple, Microsoft, and Nvidia. The aggressive remedies pursued by regulators in the Google Search case – and the Trump Administration’s decision to continue pursuing most of those Biden-era remedies – suggest that many household-name companies in the tech sector face the risk of structural breakups and de facto public utility regulation if the government succeeds in its antitrust cases. At a time of extreme economic uncertainty – consumer sentiment has plunged near pandemic-era lows – the Trump Administration should reconsider continuing Biden’s antitrust agenda and risking worse stock market performance, increased prices for high-salience goods and services, and damaged U.S. competitiveness in the global artificial intelligence (AI) race with China.

The proposed remedies in the Google Search case are the proverbial canary in the coal mine. The government has proposed four main remedies:

- Separating Chrome and potentially Android from Google;

- Requiring that Google share data and proprietary technology with most competitors going forward, significantly reducing the incentive for Google to invest in innovation while removing the need for Google’s competitors to invest in innovation;

- Prohibiting Google from marketing its search products with search distribution agreements; and

- Requiring Google to notify regulators of potential acquisition transactions related to artificial intelligence that would not otherwise require notification.

The threat of antitrust remedies such as these applied not only to Google but to six of the Magnificent Seven companies, particularly when these firms drive America’s leadership in strategic frontier technologies, risks a downward spiral of effects. The U.S. tech sector risks losing its dynamism in the face of de facto public utility-style regulation inspired by the European Union’s digital red tape that has held back tech and economic growth in a continent bursting with human capital.

Tech Is an Engine of American Prosperity

Over the past decade, the U.S. tech sector has served as the bedrock of U.S. stock market performance. These large platforms have contributed more to market capitalization growth than any other industry while simultaneously leading the nation in research and development (R&D) and capital expenditures. The sector now accounts for the largest segment of the S&P 500—generating roughly 40% of its market capitalization since 2010. In fact, the Magnificent Seven collectively represented about 30% of S&P 500 market capitalization as of March 2025, underscoring the pivotal role they play in supporting investor confidence and overall market stability.

Recent capital expenditure data highlight the magnitude of this impact. In 2023, U.S. firms spent a record $328 billion on capital investments, driven predominantly by technology powerhouses like Google and Amazon. Moreover, five large U.S. tech firms—Amazon, Alphabet, Apple, Meta, and Microsoft—are expected to invest $240 billion this year alone, largely targeted toward AI research, data centers, and cloud infrastructure. That figure is more than double their combined spending just two years ago, demonstrating both their commitment to innovation and their outsized influence on America’s future economic trajectory. According to the European Union’s Draghi Report, the top U.S. companies for R&D and innovation have shifted decisively into digital platforms over the past two decades, reflecting the strategic importance of emerging technologies.

These Remedies Risk Deepening Investors’ Losses

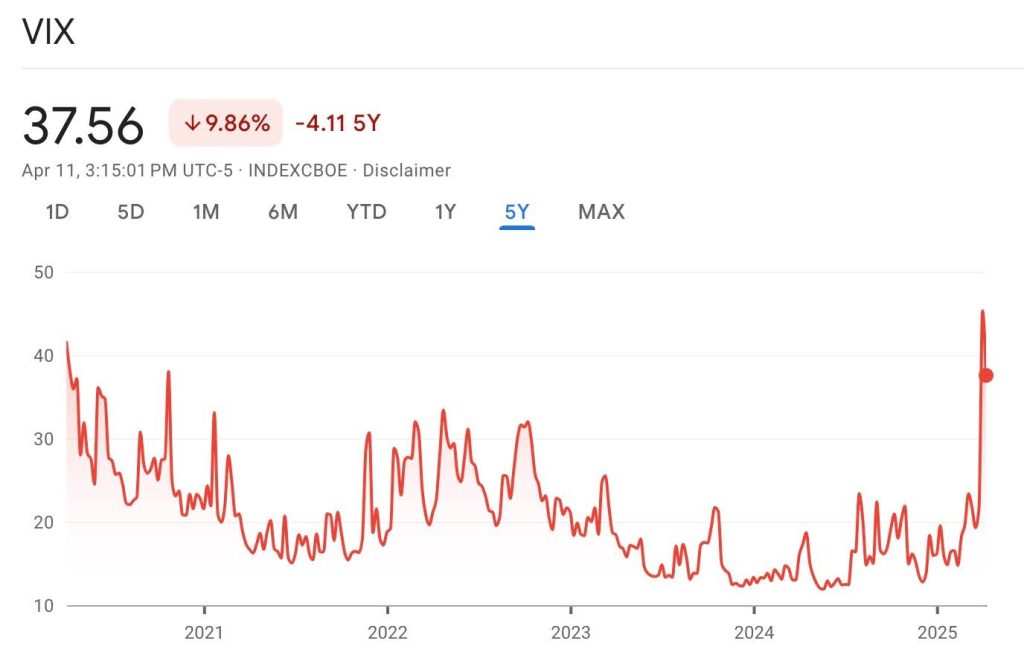

Amid intensifying geopolitical tensions, competition from well-funded Chinese tech rivals, and tariffs that inject uncertainty into global trade, investors are growing skittish. The CBOE Volatility Index (VIX) has more than doubled over the past month, with many analysts pointing to tech-specific pressures—ranging from tariffs and foreign retaliation to new export controls to threats of forced divestitures by U.S. regulators—as prime drivers. Treasury Secretary Scott Bessent recently acknowledged that the tech sector’s performance is highly correlated with overall market health, noting that “the Nasdaq peaked on DeepSeek day so that’s a Mag Seven problem, not a MAGA problem.” Undercutting the most dynamic sector of the U.S. economy through sweeping antitrust remedies would likely generate immediate ripple effects throughout already volatile equity markets and risks undermining a key engine of U.S. growth.

U.S. stocks remain incredibly volatile, and radical moves in antitrust enforcement would add fuel to the fire of market uncertainty. Investors and voters would surely notice.

These Remedies Could Cause High-Salience Price Increases

Inflationary pressures are a major concern for American consumers and voters. Disruptive remedies, such as those proposed by the Department of Justice in the Google Search case—which would prohibit revenue-sharing agreements with distributors and OEMs— could raise smartphone prices by as much as $87 per device and digital services by up to $80 per person. The recent trade war is reducing margins for many companies, including device manufacturers, so the potential for firms to internalize increased costs and lost revenues from remedies has fallen considerably. For example, many smartphone manufacturers currently receive revenues from Google’s search distribution agreements. Under the proposed remedies in the Google Search case, those agreements would be prohibited, and device manufacturers would lose a revenue stream just as tariffs are reducing margins and creating upward pressure on prices. At a time when inflation remains stubbornly above target and concerns about stagflation are emerging, it is politically risky to impose remedies that could increase prices for products that are very salient to consumers and voters.

It would be deeply ironic for antitrust remedies against tech companies to result in increased consumer perceptions of inflation due to higher prices for salient goods like smartphones. Tech platforms play a uniquely deflationary role by offering free or low-cost services, while also driving down prices for a wide range of consumer goods. The Adobe Digital Price Index shows that while the Consumer Price Index increased by 36% since January 2014, online prices for a mostly comparable basket of goods declined by 25%.

These Remedies Risk Harming U.S. Competitiveness in Frontier Technologies

At risk is not just near-term stock market performance or price stability for salient products, but America’s global leadership in frontier technologies like AI. As AI rapidly transforms the global economy, the United States must stay at the forefront of cutting-edge R&D to maintain a strategic advantage over rivals. The technology companies under antitrust scrutiny are the same entities collectively pouring hundreds of billions of dollars into AI infrastructure, research, patents, and commercialization. If enforcement actions fracture or constrain these firms, it increases the risk that state-supported foreign competitors—particularly in China— seize the lead in AI, semiconductors, and quantum computing. This is a national security risk as well as an economic one.

Follow the First Rule of Holes

The United States faces a moment of extreme economic uncertainty, as reflected in U.S. equity, bond, and currency markets. It is precisely the wrong moment to choose to add additional policy uncertainty through radical antitrust action.

Zooming out from the markets, the United States finds itself in an era defined by geopolitical uncertainty, technology-driven transformation, intensifying global competition, and inflation concerns. It would be economically shortsighted to dismantle or heavily constrain the very firms that anchor U.S. market stability, offer popular best-in-class services for free, foster innovation, and drive American leadership in AI and other frontier technologies. Rather than imposing public-utility-style regulations on competitive markets or preemptively breaking up successful companies, policymakers should focus on fostering innovation and ensuring that they aren’t breaking an engine of American prosperity. The consequences of proceeding with the wrong remedies now could be irreversible—and could hand the 21st century to America’s rivals, particularly China.