Recent reports indicate that the U.S. Congress is considering attaching a proposal to preempt state-level discriminatory regulation of AI to the National Defense Authorization Act (NDAA). If enacted, such federal preemption would prevent regulatory inconsistencies between states or unduly high regulatory burdens in particular states that could slow AI adoption and deployment. In addition to boosting productivity growth, increasing GDP growth, and helping the U.S. beat China in the AI race, federal preemption would provide a fiscal windfall: Federal preemption of state-level AI regulation would save the federal government about $600 billion through 2035.

The $600 billion fiscal savings from 2026 through 2035 would result from:

- $39 billion in lower procurement costs for the federal government due to increased productivity of federal contractors, and

- $561 billion in higher federal tax receipts flowing from an AI-enabled jump in GDP resulting from the AI boost to productivity.

Regulatory Fragmentation Would Slow AI Deployment, Adoption

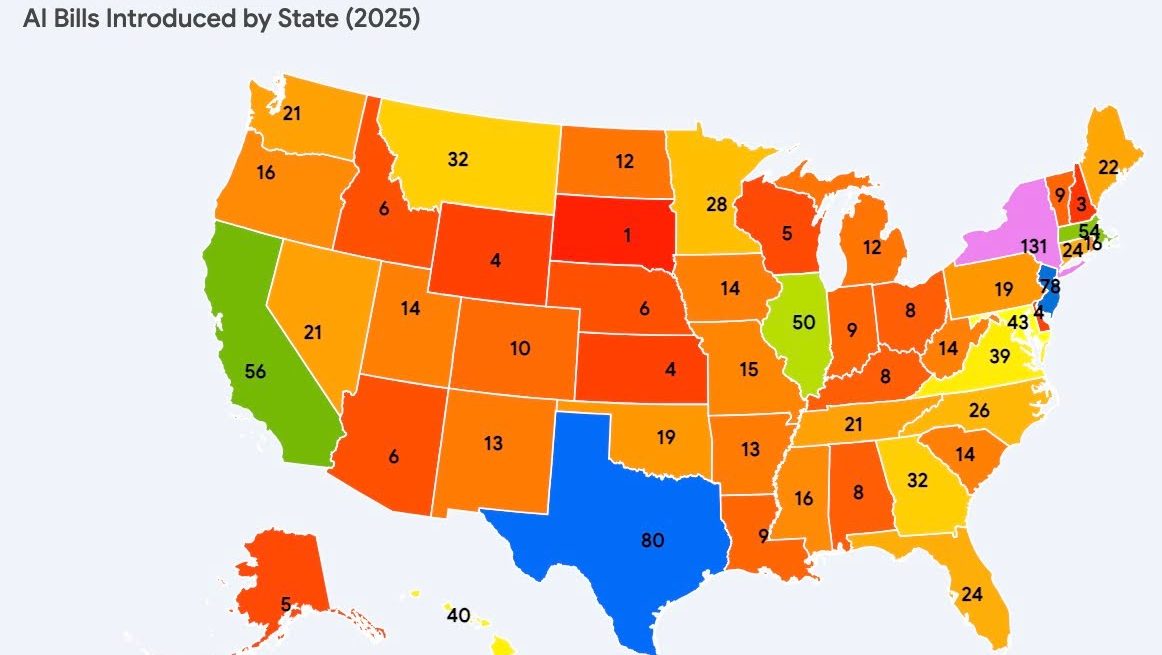

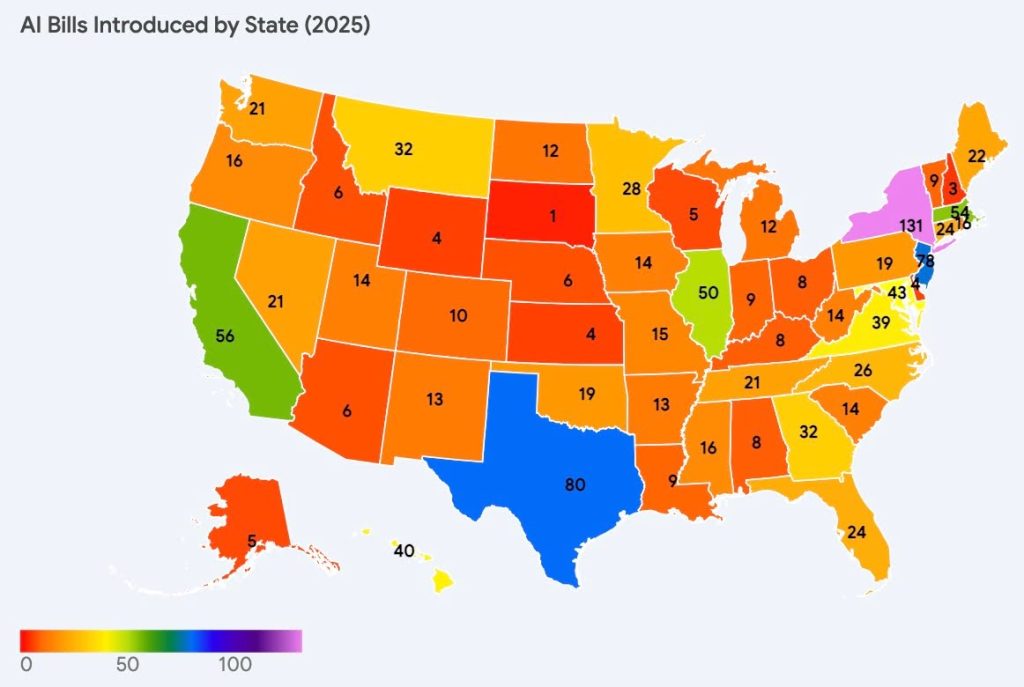

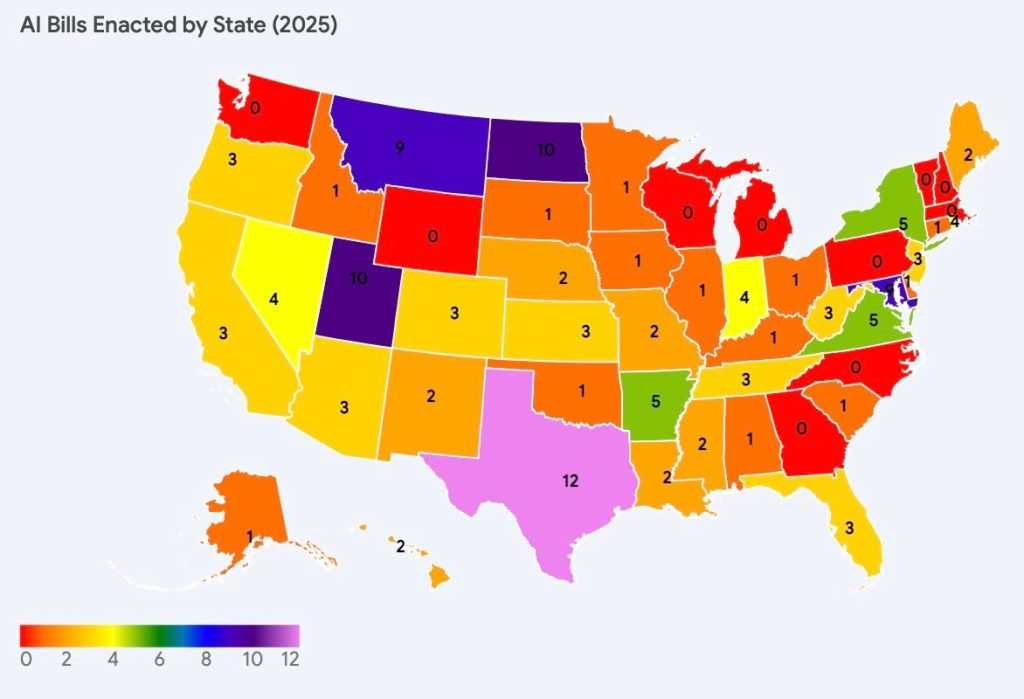

According to data from the National Conference of State Legislatures, in 2025, state lawmakers introduced 1,134 bills to regulate AI and enacted 131 AI regulatory bills into law. Every single state’s legislature had at least one AI regulatory bill introduced in 2025, and 40 states enacted at least one AI regulatory law. The average state enacted 2.6 laws targeting AI in 2025. These bills and laws were not all aligned, and already AI regulatory requirements are beginning to diverge between states. Developers of AI-enabled tools will have to program distinct properties by state, and run the risk of significant potential liability for services involving multiple persons across state lines with different and potentially conflicting requirements. In the absence of federal preemption of state laws targeting AI, each state could plausibly pass an average of 2 to 3 laws targeting AI every year for the foreseeable future, each conflicting with one or more other states’ laws, until the market is so fragmented that AI deployment, adoption, and innovation slow to a crawl.

Table 1: State AI Regulatory Bills Introduced and Enacted in 2025, by State

| State | AI Bills Introduced | AI Bills Enacted |

| Alabama | 8 | 1 |

| Alaska | 5 | 1 |

| Arizona | 6 | 3 |

| Arkansas | 13 | 5 |

| California | 56 | 3 |

| Colorado | 10 | 3 |

| Connecticut | 24 | 1 |

| Delaware | 4 | 1 |

| Florida | 24 | 3 |

| Georgia | 32 | 0 |

| Hawaii | 40 | 2 |

| Idaho | 6 | 1 |

| Illinois | 50 | 1 |

| Indiana | 9 | 4 |

| Iowa | 14 | 1 |

| Kansas | 4 | 3 |

| Kentucky | 8 | 1 |

| Louisiana | 9 | 2 |

| Maine | 22 | 2 |

| Maryland | 43 | 9 |

| Massachusetts | 54 | 0 |

| Michigan | 12 | 0 |

| Minnesota | 28 | 1 |

| Mississippi | 16 | 2 |

| Missouri | 15 | 2 |

| Montana | 32 | 9 |

| Nebraska | 6 | 2 |

| Nevada | 21 | 4 |

| New Hampshire | 3 | 0 |

| New Jersey | 78 | 3 |

| New Mexico | 13 | 2 |

| New York | 131 | 5 |

| North Carolina | 26 | 0 |

| North Dakota | 12 | 10 |

| Ohio | 8 | 1 |

| Oklahoma | 19 | 1 |

| Oregon | 16 | 3 |

| Pennsylvania | 19 | 0 |

| Rhode Island | 16 | 4 |

| South Carolina | 14 | 1 |

| South Dakota | 1 | 1 |

| Tennessee | 21 | 3 |

| Texas | 80 | 12 |

| Utah | 14 | 10 |

| Vermont | 9 | 0 |

| Virginia | 39 | 5 |

| Washington | 21 | 0 |

| West Virginia | 14 | 3 |

| Wisconsin | 5 | 0 |

| Wyoming | 4 | 0 |

| TOTAL | 1,134 | 131 |

Source: Author’s calculations based on underlying data from National Conference of State Legislatures, “Artificial Intelligence 2025 Legislation”, Updated July 10, 2025, available at https://www.ncsl.org/technology-and-communication/artificial-intelligence-2025-legislation, accessed November 25, 2025.

$39 Billion in Federal Procurement Savings from Federal Preemption of State AI Regulation

A $1.3 trillion opportunity space: In FY 2023 the federal government obligated roughly $759 billion on contracts for everything from aircraft to accounting services, according to the Government Accountability Office. Roughly $478 billion of that total was for services. A large share of those service dollars flow to professional-services contractors like consultants, systems integrators, accountants, and lawyers whose own cost structures are overwhelmingly dominated by labor. In FY 2024, the federal government spent about $126 billion on professional services contractors. Over a decade, this suggests that the federal government would spend about $1.3 trillion on professional services contracts alone.

Regulatory fragmentation compliance costs get passed on to taxpayers, including through reduced AI adoption: In the absence of federal preemption of state-level regulations targeting AI, a firm that offers AI-enhanced professional services could have to certify one model for California and another for New York. In some cases, contractors would have to avoid offering services in entire states because the compliance burden was prohibitive. This risk is particularly high in cases where state-level rules conflict with one another, creating circumstances where AI tool developers would have to pick a state whose rules to follow and a state from which to exit. For example, when a tool would need to be used by employees operating across state lines with conflicting requirements, there may be no way to allow those employees to interact using the AI-enabled tool that does not create liability risk.

The resulting regulatory fragmentation of the market would prevent economies of scale, not only in compliance, but in the scale of offerings overall. For example, if your California offices cannot work in coordination with any staff in your Texas offices due to conflicting state-level AI regulations, the scale of your offerings shrinks correspondingly, and your AI deployment and adoption rates likely shrink as well. The cost of building 50 bespoke compliance programs, or putting up “firewalls” between teams working in different states and using different tools subject to different regulations, does not stay in Sacramento or Austin. Rather, it is embedded in the cost rates that show up on GSA schedules and ultimately on federal invoices. By preempting discriminatory state rules, Congress would let professional services vendors achieve economies of scale and high levels of productivity-enhancing AI adoption across the entire U.S. market, pushing their average cost, and therefore their bid prices, down.

Magnitude of the procurement cost savings from federal preemption: Recent empirical evidence from the CCIA Research Center’s 2025 SPICE AI Report indicates that U.S. workers using AI tools already experience an average productivity boost of 15%. If harmonization of AI rules nationwide increases AI deployment and worker adoption by just 20% for professional services firms across a 10-year fiscal window, that would amount to a 3% productivity improvement even in the absence of further improvement in AI capabilities. Across $1.3 trillion in baseline federal contracting of professional services across a 10-year window, a 3% productivity improvement allows $39 billion in federal procurement cost savings over a decade. Competitive bidding pressures will force vendors to lower prices as their costs drop, making these savings plausible.

- This estimate is conservative, as it ignores the many procurement cost savings likely to be achieved by federal services contractors outside of professional services and the likelihood of ongoing dramatic increases in AI capabilities over the next decade. Keep in mind that the modern era of publicly-rolled out generative AI tools began just three years ago in November 2022, and the models and tools available today are vastly improved over the ones available in 2022.

$561 Billion in Incremental Federal Revenues From Federal Preemption of State AI Regulations

Macroeconomic upside: AI is widely viewed as a general-purpose technology akin to electricity or the internet. In June of 2023, McKinsey estimated that AI could increase labor productivity growth by up to 0.6% per year through 2040 with widespread adoption. More recent economic estimates from within the past year from Vanguard, Goldman Sachs, and McKinsey imply a $2.9 trillion to $5.3 trillion boost in annual GDP by 2035, with even the more cautious estimates from Penn Wharton coming in around $660 billion in GDP boost by 2035.

Table 2: Leading Estimates of AI Economic Impact from Dec 2024-Nov 2025

| Institution | Report and Date | Projected Impact | Implicit US GDP Impact by 2035 |

| Vanguard | Megatrends and AI: What It Means for Our Jobs and the Future of Work (December 2024) | “Spread out over 10 years, that 20% productivity lift per year would put GDP growth near 3% during the 2030s.” | $5.3 Trillion (Annual) [Implicit; estimated difference between 3% growth trajectory and CBO’s 1.8% baseline over a decade.] |

| Goldman Sachs | China’s Advances Could Boost AI’s Impact on Global GDP(February 12, 2025) | “[W]idespread adoption of generative AI could raise US labor productivity by 15% over roughly 10 years, mainly by automating work tasks.” | $4.5 Trillion (Annual) [Explicit Estimate] |

| McKinsey | Agents, Robots, and Us: Skill Partnerships in the Age of AI(November 25, 2025) | “By 2030, about $2.9 trillion of economic value could be unlocked in the United States” | $2.9 Trillion (Annual) [Explicit Estimate] |

| Penn Wharton | The Projected Impact of Generative AI on Future Productivity Growth(September 8, 2025) | “We estimate that AI will increase productivity and GDP by 1.5% by 2035” | $660 Billion (Annual) [Calculated as 1.5% of the CBO’s projected $44T nominal GDP for 2035.] |

What that means for the Treasury: Federal receipts historically average 17.3 percent of GDP according to the Congressional Budget Office. Apply that ratio to even the most conservative of the leading estimates, from Penn Wharton, and you get not only an annual GDP boost of almost $660 billion by 2035, but a resulting 17.3% of the resulting incremental GDP each year in additional federal tax receipts, for a cumulative federal revenues “dividend” of $561 billion from 2026 through 2035.

Table 3: Incremental GDP and Federal Revenues from Federal Preemption of State AI Laws

| Year | CBO Baseline GDP (Billions $USD) | GDP With Federal Preemption of State AI Regs (Billions $USD) | Annual Incremental GDP (Billions $USD) | Annual Federal Revenues Dividend (Billions $USD) |

| 2025 | 30,136 | 30,136 | ||

| 2026 | 31,341 | 31,388 | 47 | 8 |

| 2027 | 32,538 | 32,635 | 97 | 17 |

| 2028 | 33,765 | 33,916 | 151 | 26 |

| 2029 | 35,047 | 35,256 | 209 | 36 |

| 2030 | 36,394 | 36,666 | 272 | 47 |

| 2031 | 37,792 | 38,131 | 339 | 59 |

| 2032 | 39,252 | 39,663 | 411 | 71 |

| 2033 | 40,768 | 41,256 | 488 | 85 |

| 2034 | 42,330 | 42,901 | 571 | 99 |

| 2035 | 43,936 | 44,595 | 659 | 114 |

| 10 Year Total | 561 |

Federal preemption is essential to capture those gains: The incremental federal tax receipts are dependent on incremental GDP growth. Incremental GDP growth in turn is dependent on productivity growth. Productivity growth from AI innovation materializes only when technologies diffuse beyond pilot projects and are adopted into workers’ day-to-day workflows. Regulatory compliance-induced fragmentation slows that diffusion in at least three ways:

- Delayed roll-outs: Vendors spend time shipping state-specific compliance features and red-lining state-specific contract riders instead of shipping innovative features for users.

- Reduced market size: Complying with 50 different regulatory frameworks shrinks each state into its own smaller market, reducing options available in each market, reducing AI tool developers’ incentives to invest in offering more or better AI tools, raising costs to developers and customers, reducing employers’ incentive to invest in deploying AI tools and training workers, and reducing workers’ incentive to adopt AI into their workflows.

- Higher legal risk premiums: A single state-level liability risk, especially from a private right of action or a right of action in the hands of a hostile state attorney general, can freeze an entire category of AI tools statewide. Such risks can spread nationwide if the state in question is unavoidable by AI tool developers or customers, or if it leads insurers to refuse to underwrite the risk. Even in less extreme cases such liability risks can significantly increase insurance premiums, decreasing incentives to deploy AI tools or adopt AI-enhanced workflows.

Preemption of state-level laws that specifically target AI removes these frictions, allowing AI to scale across all 50 states simultaneously. The faster the diffusion, the sooner the productivity dividend reaches GDP figures and thus federal tax receipts. In the absence of a federal law preempting state-level discriminatory regulation of AI, AI adoption would likely slow significantly in the U.S., pushing most of the domestic benefits of AI further into the future and outside a standard 10-year budget window for fiscal analysis.

Policy Implications

The fiscal math is clear with respect to federal preemption of state AI laws: $39 billion in procurement cost savings and $561 billion in increased federal tax receipts leave $600 billion in fiscal benefits over the next decade that should be counted in fiscal impact scores. Notably, these estimates use the most conservative of the leading estimates of the potential economic impact of widespread deployment of AI tools and systematic adoption by workers, so it is plausible the benefits of federal preemption will be significantly larger.

Because the federal fiscal benefits of preemption of state AI regulations are so large, preemption could pay for a range of priorities. For illustrative examples:

- Most straightforwardly, federal preemption could provide $600 billion in reduced deficits over the next decade; or

- Federal preemption of state AI regulations could provide fiscal space sufficient to send every adult U.S. citizen a $2,500 “AI dividend check” and provide $3 billion in reduced deficits through 2035; or

- Federal preemption of state AI regulations could pay to extend ACA subsidies through 2035, and pay to send every adult U.S. citizen a $1,000 “AI dividend check”, and reduce deficits by about $11 billion through 2035.

Conclusion

Fiscal sustainability requires both spending discipline and faster growth. Federal preemption of discriminatory state AI rules advances both goals at once by cutting procurement costs today while planting the seeds for higher economic growth and federal revenues tomorrow. Congress should seize this rare policy lever that aligns innovation, abundance, and fiscal responsibility.